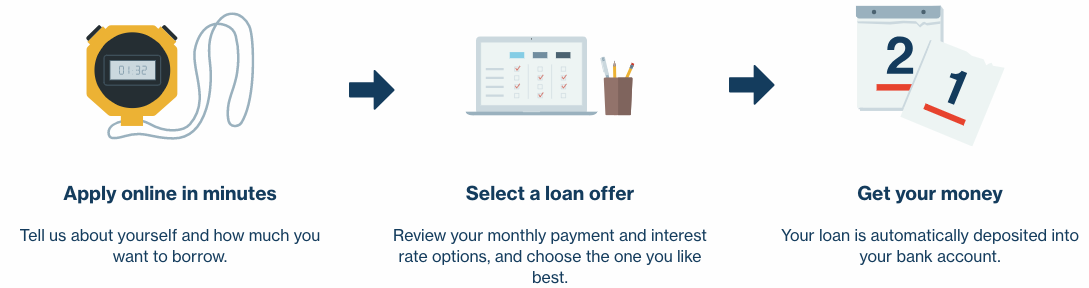

lending club approval process

Unless otherwise specified all loans and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of LendingClub Corporation NMLS ID 167439. The company allows customers to apply for a loan for basically anything.

Lendingclub Review My Experience Using Lendingclub

A mortgage is a legal instrument which is used to create a security interest in real property held by a lender as a security for a debt usually a loan of money.

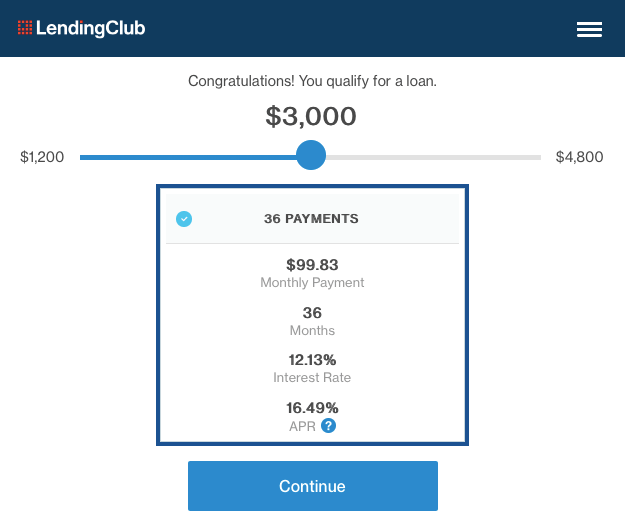

. Loans are subject to credit approval and sufficient investor commitment. Jump forward to 1999 and online banking is a thing and borrowers no longer need to step outside their house or even have any social interactions to apply for a loan cue the onset of. Loans are subject to credit approval and sufficient investor commitment.

Only deposit products are FDIC insured. Quicken Loans in Detroit drastically sped up the lending process in 1985 its in the name by offering most of their application and review process online. Marketplace revenue was 136 higher and net interest income grew 259 year over year.

Only deposit products are FDIC insured. Deposit accounts are subject to approval. It is a transfer of an interest in land or the equivalent from the owner to the mortgage lender on the condition that this interest will be returned to the.

Loans are subject to credit approval and sufficient investor commitment. Lending Club faced a record full year in 2021 with revenue of 8186 million up 157 compared to 2020. Unless otherwise specified all loans and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of LendingClub Corporation NMLS ID 167439.

Unless otherwise specified all loans and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of LendingClub Corporation NMLS ID 167439. A mortgage in itself is not a debt it is the lenders security for a debt. LendingTree offers personal loans in the amounts of 5000 - 50000.

Some of the main uses include debt and credit card consolidation home purchase financing.

How To Apply For A Personal Loan 6 Steps Lendingclub

How Lendingclub Wants To Make History The Motley Fool

Lending Club Review For Borrowers 2019 Is This Company Legit

Lendingclub Com My Peer To Peer Loan Review Financial Sumo

Lendingpoint Vs Lending Club 9 Differences Easy Choice

Lending Club Offers New Lenders 50 To Get Started On Its Peer To Peer Platform Finovate

Lendingclub Personal Loans Review 2022 Nextadvisor With Time

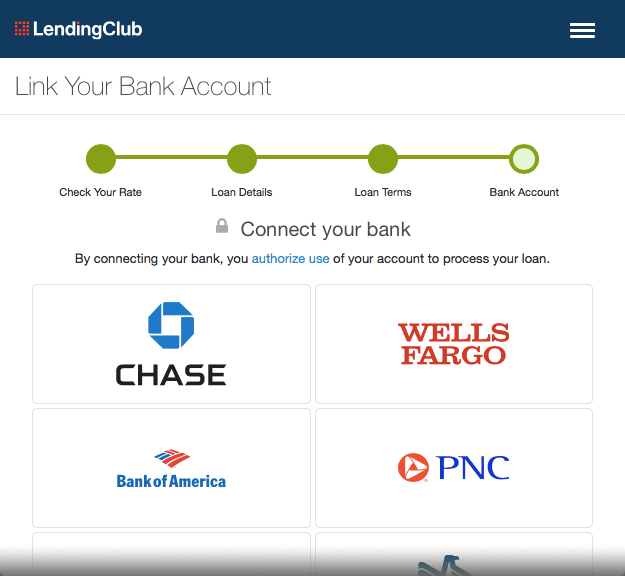

How To Apply For A Loan On Lending Club Lendit Fintech News

Lending Club Review For Borrowers 2019 Is This Company Legit

How Long Does It Take To Get Approved For A Loan Lendingclub

Lendingclub Com My Peer To Peer Loan Review Financial Sumo

Lendingclub Personal Loans 2022 Review Moneyrates

Lending Club Loan Application Process What To Expect Lend Academy

P2p Lending Archives Page 2 Of 7 Finovate

What To Expect When Borrowing From Lending Club Pt Money

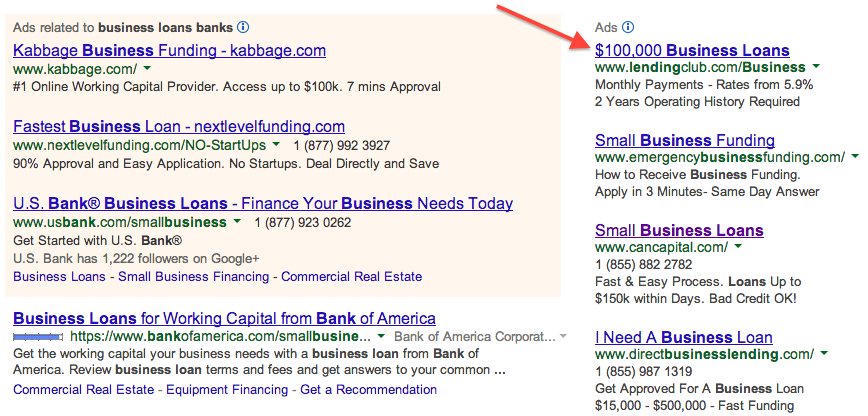

Lending Club Expands Into Small Business Loans Lendit Fintech News

Personal Loan Eligibility Criteria Lenders Look For Lendingclub

Lendingclub Personal Loans Review 2022 Nextadvisor With Time

Lending Club Review For Borrowers 2019 Is This Company Legit